Cit Bank available balance: A seemingly simple phrase, yet it holds the key to unlocking a world of financial possibilities and anxieties. It’s a number, a fleeting figure on a screen, yet it represents the culmination of your hard work, your careful budgeting, your triumphs and tribulations in the realm of finance. This number, this balance, whispers tales of success or warns of impending storms.

It’s a reflection of your current financial standing, a snapshot in time that dictates the choices you can make, the dreams you can pursue, and the anxieties that may haunt your nights.

Understanding your Cit Bank available balance is paramount. It’s the foundation upon which you build your financial future. Knowing precisely how much you have readily accessible allows for informed decision-making, preventing overspending and fostering a sense of financial control. It empowers you to navigate the complexities of modern life with confidence, knowing that you have a clear picture of your financial landscape.

Navigating your finances can sometimes feel like deciphering an ancient scroll. Understanding your available balance, especially with a large institution like Citibank, is crucial for responsible financial management. This comprehensive guide will illuminate the intricacies of your Citibank available balance, addressing common queries and misconceptions.

What is Citibank Available Balance?

Your Citibank available balance represents the amount of money you can immediately spend or withdraw from your account without incurring overdraft fees. It’s the readily accessible funds you have at your disposal. This is distinct from your total account balance, which includes pending transactions, deposits in transit, and other funds not yet fully available.

Source: logicaldollar.com

Factors Affecting Your Available Balance

- Pending Transactions: Transactions initiated but not yet processed by Citibank (e.g., online purchases, pending checks) will reduce your available balance.

- Scheduled Payments: Recurring bills or scheduled transfers will decrease your available balance before the actual payment date.

- Deposits in Transit: Deposits made (e.g., mobile check deposit) are not immediately reflected in your available balance until they clear. This typically takes 1-3 business days.

- Hold Amounts: Citibank might place a hold on funds for certain transactions, such as large purchases or international transfers, until the transaction is verified.

- Overdraft Protection (if enrolled): If you have overdraft protection, your available balance might reflect the available credit line, allowing you to spend beyond your actual balance. However, this usually comes with fees.

- Account Fees: Monthly maintenance fees or other charges will reduce your available balance.

How to Check Your Citibank Available Balance

Citibank offers multiple convenient ways to access your available balance:

Online Banking, Cit bank available balance

Logging into your Citibank online account provides real-time access to your available balance. This is generally the most accurate and up-to-date method.

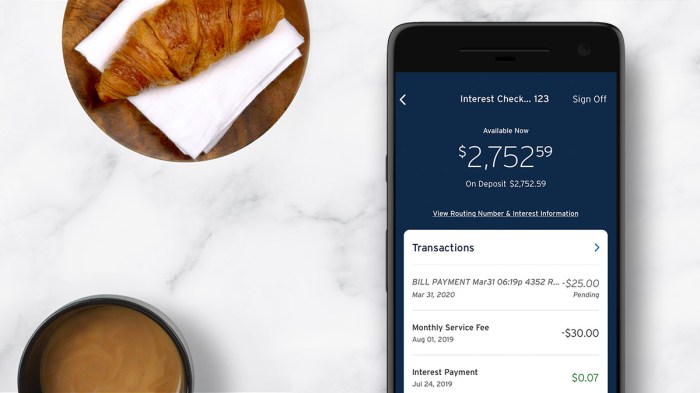

Mobile Banking App

The Citi Mobile app offers the same convenience as online banking, allowing you to check your available balance anytime, anywhere.

Source: citi.com

ATM

Using a Citibank ATM allows you to quickly view your available balance without logging into an account.

Telephone Banking

Calling Citibank’s customer service line provides access to your available balance information.

Bank Statements

While not real-time, your bank statements provide a record of your transactions and available balance at a specific point in time.

Understanding the Difference Between Available Balance and Total Balance

It’s crucial to understand the distinction: Your available balance is what you can spend immediately. Your total balance includes all funds in your account, regardless of whether they are immediately accessible. The difference lies in pending transactions and other factors mentioned earlier.

Troubleshooting Available Balance Discrepancies

If you notice discrepancies between your expected available balance and what’s shown on your account, consider these steps:

- Check Pending Transactions: Review your recent transactions for any pending items that might be affecting your available balance.

- Verify Deposits: Ensure that all deposits have cleared. Contact Citibank if a deposit is delayed.

- Review Account Fees: Check for any unexpected fees that might have reduced your available balance.

- Contact Citibank Customer Service: If you’re still unsure, reach out to Citibank’s customer service for assistance.

Citibank Available Balance and Overdraft Fees

Exceeding your available balance can lead to overdraft fees. Understanding your available balance is critical to avoiding these charges. Consider setting up overdraft protection or monitoring your account closely to prevent overdrafts.

s:

Citibank available balance, Citibank account balance, available funds Citibank, checking account balance Citibank, Citibank online banking, Citibank mobile app, pending transactions Citibank, deposits in transit Citibank, Citibank overdraft, Citibank fees, Citibank customer service, how to check Citibank balance, understand Citibank balance, Citibank account statement, Citibank available balance vs total balance.

Frequently Asked Questions (FAQ): Cit Bank Available Balance

- Q: Why is my available balance lower than my total balance? A: This is because your total balance includes funds that are not yet available for immediate use, such as pending transactions and deposits in transit.

- Q: How long does it take for a deposit to be reflected in my available balance? A: Typically 1-3 business days, but it can vary depending on the deposit method.

- Q: What happens if I spend more than my available balance? A: You may incur overdraft fees, depending on your account type and whether you have overdraft protection.

- Q: How can I avoid overdraft fees? A: Regularly monitor your available balance, set up alerts for low balances, and consider overdraft protection (though it comes with fees).

- Q: Where can I find my available balance? A: You can find it through online banking, the mobile app, ATMs, telephone banking, and bank statements.

References

While specific internal Citibank documents are not publicly available, general information on banking practices can be found on reputable financial websites. Always refer to your official Citibank account agreements and terms for the most accurate and up-to-date information.

Call to Action (CTA)

Take control of your finances today! Log into your Citibank online account or mobile app to check your available balance and ensure you’re managing your funds effectively. If you have any questions, don’t hesitate to contact Citibank customer service.

The seemingly insignificant figure representing your Cit Bank available balance is, in reality, a powerful tool. It’s a window into your financial well-being, a reflection of your financial choices, and a compass guiding you toward a secure future. By diligently monitoring this balance and understanding its implications, you seize control of your financial destiny, paving the way for a more prosperous and less stressful tomorrow.

The power lies not just in the number itself, but in the knowledge and responsibility it inspires.